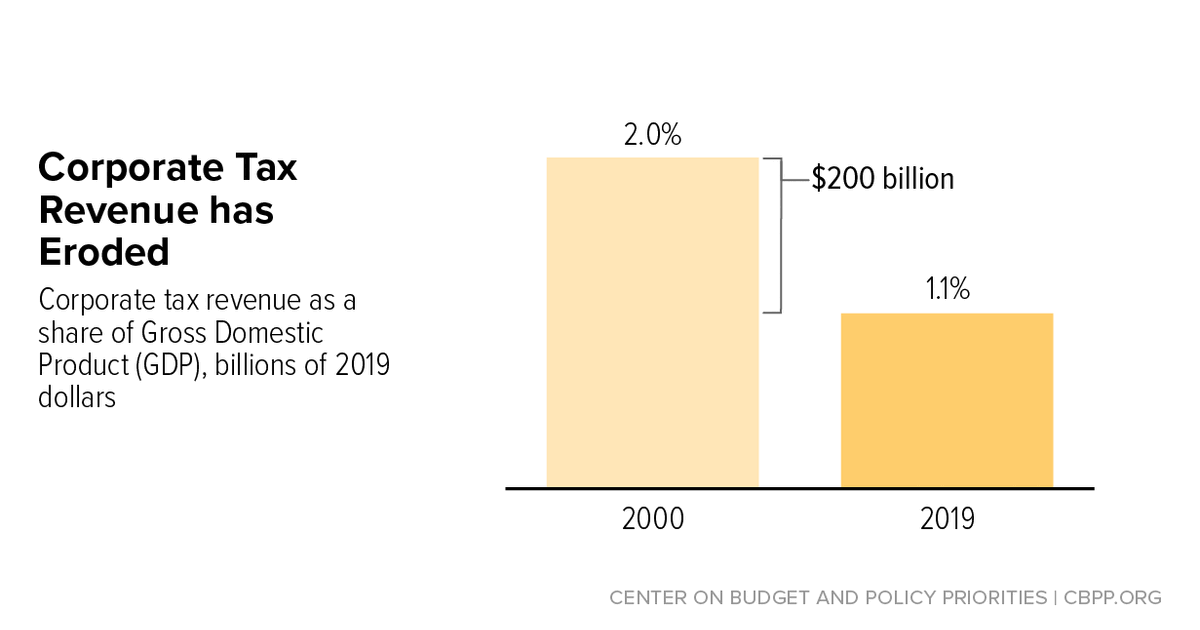

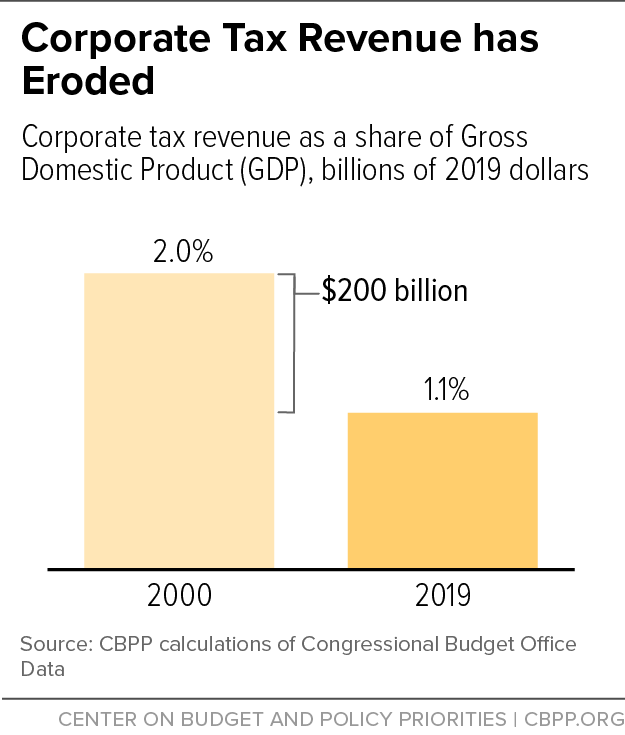

Corporate Rate Increase Would Make Taxes Fairer, Help Fund Equitable Recovery | Center on Budget and Policy Priorities

Corporate Rate Increase Would Make Taxes Fairer, Help Fund Equitable Recovery | Center on Budget and Policy Priorities

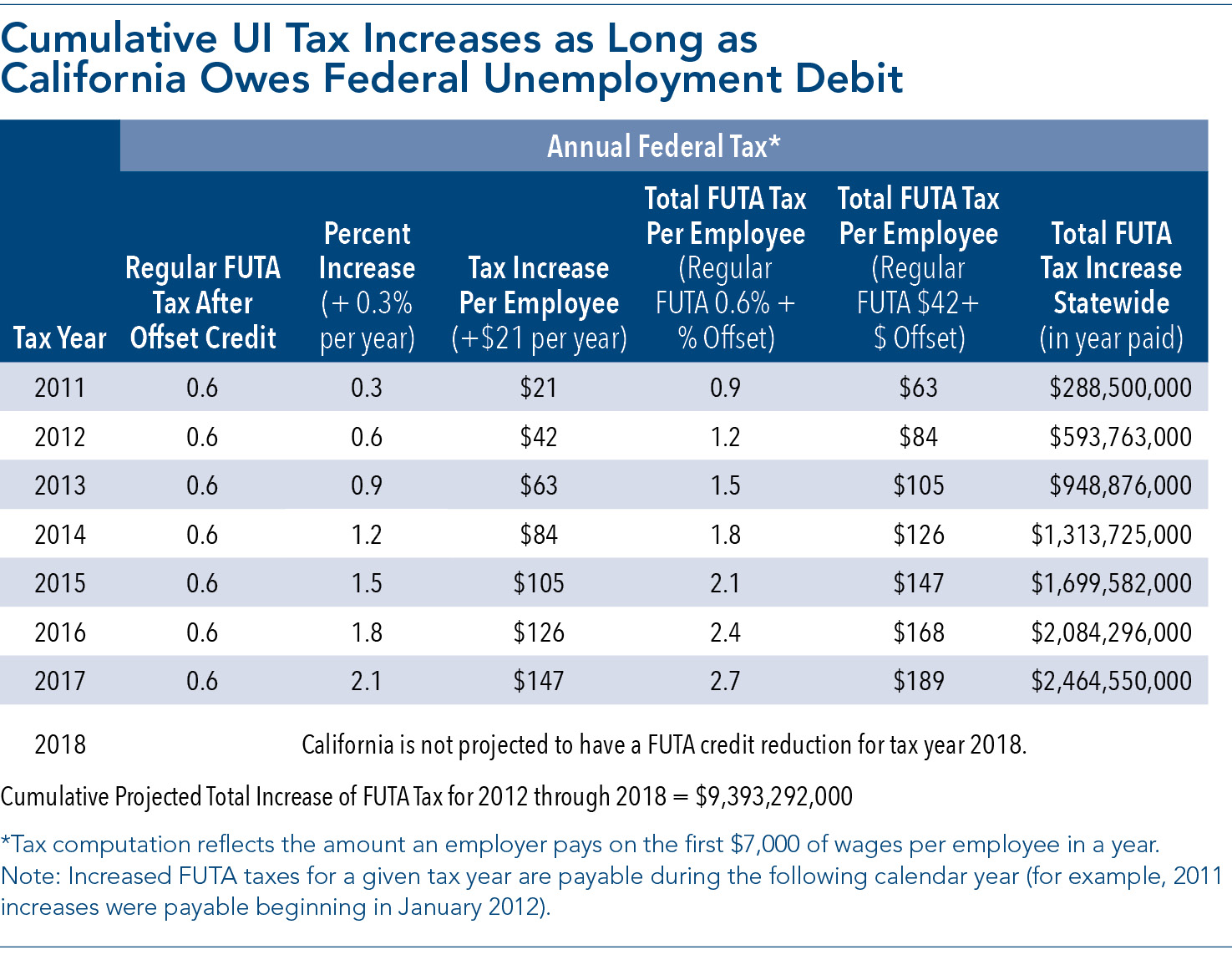

Federal Unemployment Insurance Taxes: California Employers Paying More - Advocacy - California Chamber of Commerce